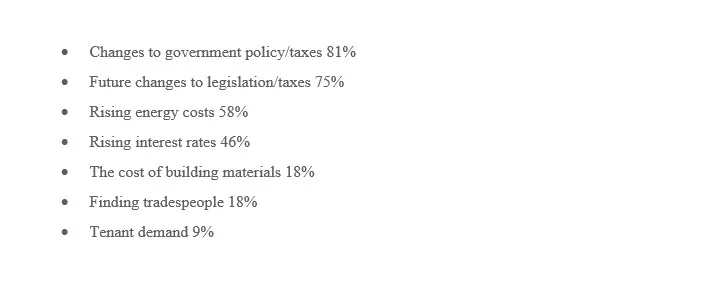

Blackrose Accountants found these results very interesting. The results shows most of the people who answered this poll were not intending to grow their property portfolio and were in the rental market to protect their existing income streams. With 75%-80% of the people polled being more worried about government intervention while only 18% were worried about rising material and tradesman costs.

Impact of taxation

When looking at this from a P&L perspective, taxation accounts for 20% of the 20% net profit remaining of the rental income. That is just 4% of sales. This could not really be the biggest threat to a growing business. Less than 5% is usually within the range of not materially significant. Only businesses looking to maximise every last penny would worry about taxation. However, for those who own properties in their personal name, taxation could jump to 25% of rental income, as interest is not deductible at a higher rate.

Impact of rising interest rates

Rising interest rates, which represented a worry for 46%. So what percentage of revenue does interest eat up? For those that are overleveraged this could be a big worry. With rental yields as low as 2-3% in some parts of the SE England, an investor with a modest 75% LTV could see 90% their income eaten up if rates doubled from historical lows. In addition, they would still have a tax bill to pay if they owe the property in their personal names even though they have had negative cash flows.

The next highest thing was energy costs with 58%. Why would a property investor in the rental market be worried about rising energy costs? Only if the business was running a service accommodation or HMO and had included energy in the service provided and now prices have gone up are subsidising the tenant’s energy consumption. However, 58% of property investors are on HMO property owners.

So for those not expanding these are worrying time which could lead to motivated seller selling property during time of rising inflation

Blackrose Accountants are specialises in providing bookkeeping, accountancy, taxation, payroll services and business development and advisory services The areas we cover include

- Wembley

- Brent

- Willesden

- Harrow

- Kingsbury

- Kenton

- Pinner

For a free consultation contact us at

Blackrose Accountants – Wembley, Harrow, Kenton

- Croydon

- Thornton Heath

- South Norwood

- Crystal Palace

- Selhurst Park.

- Beckenham

- Streatham

For a free consultation contact us at

Blackrose Accountants – Croydon, South Norwood, Thornton Heath