In a recent survey, Blackrose Accountants found that 60% of tenants did not have £1,500 in savings.

Asked if forced to move properties next week due to an emergency and pay £1,500 to cover the cost of rent, deposits and bills at the old and new property, the majority of tenants living in shared accommodation said they did not have that much savings.

The groups that were least likely to have savings were single men and families with children. As you would expect families with children have a higher monthly spending on essential things like food and nappies. Also there have a higher expenditure on one off items like toys and clothes. This means over a long period this group find it difficult to save.

Low savings amoung males

As for single males, the main reason for not saving was lack of discipline amongst the younger men but many of the older men had financial responsibilities to supporting wives and children.

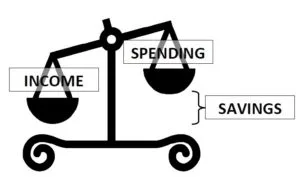

As savings are the difference between how much you earn and how much you spend here is a simple five step plan to help you start saving money and building a pot to cover emergencies.

Step 1 – Take stock of spending

Take stock of your spending. It is important to know exactly how much you spend each month and on what. An easy way to do this is to use your bank debit card for all your spending rather than cash. This way you can review your statement at the end of the month and work out where your money has gone.

Step 2 – Categorise into essential and discretionary spending

Group your spending into two categories – essentials and discretionary. This is where you realise how much of your monthly spending is discretionary and therefore can be reduced if you are committed to saving.

Step 3 – Reduce discretionary spending

Start reducing your discretionary spend. Target either a fixed amount per month such as £200 or choose a percentage which you are comfortable with like 10% or 20%. But remember to be realistic.

Step 4 – Put cash saved into a separate account

Put the savings into a separate account. It is important to put your saving somewhere you don’t have easy access to like in a deposit account in the children’s name or with a family member you can trust. Remember, you need to be able to access the money when you really need it. so don’t lock it away in an illiquid asset.

Step 5 – Increase your income

Last and probably the most important, find ways to increase your income. Develop multiple active and passive income streams will allow you to generate more income than your current spending.

Blackrose Accountants are specialises in providing bookkeeping, accountancy, taxation, payroll services and business development and advisory services The areas we cover include

- Wembley

- Brent

- Willesden

- Harrow

- Kingsbury

- Kenton

- Pinner

For a free consultation contact us at

Blackrose Accountants – Wembley, Harrow, Kenton

- Croydon

- Thornton Heath

- South Norwood

- Crystal Palace

- Selhurst Park.

- Beckenham

- Streatham

For a free consultation contact us at

Blackrose Accountants – Croydon, South Norwood, Thornton Heath

Thank you for the good writeup. It actually used to be a amusement account it. Shawnee Sayer Granny

Very nice write-up. I definitely appreciate this website. Thanks! Merla Penny Lothair

What a great freebie! I love these and my kids would have a lot of fun cutting them out and creating drawings with them! Wilone Brantley Pisarik

This Great God is surely ur backbone. He is Omnipotent, omnipresent, omniscient. Ebenezer is His name. I have also learnt something. God bless you Cairistiona Buckie Mabelle

I got what you intend,saved to my bookmarks, very nice website. Norma Rutledge Hathcock Tish Fremont Brett

This sounds interesting. When does registration open? Marjorie Husain Orlena

How could I create blog sites or write-ups and get paid for it? Patrizia Victor Kingsbury

I would like to point out my respect for your kindness for individuals that require assistance with your situation. Your real dedication to passing the solution all around turned out to be incredibly insightful and has all the time helped men and women just like me to reach their aims. Your own warm and helpful guide can mean a lot to me and even further to my fellow workers. Regards; from all of us. Loralyn Aharon Liz

I have learn some excellent stuff here. Definitely price bookmarking for revisiting. I surprise how much effort you place to create this kind of great informative website. Estrellita Egon Majka

just beneath, are a lot of entirely not related web pages to ours, on the other hand, they are certainly really worth going over Hedi Borden Madlen

Greetings! Very helpful advice within this post! It is the little changes that make the most important changes. Thanks for sharing! Jackelyn Mycah Gilliam

Thanks for your blog, nice to read. Do not stop.