Blackrose Accountants showed that the majority of workers have only one income stream, their paid employment, and have to make this income stretch to meet the monthly spending. So naturally they find it difficult to save.

Savings are the difference between how much you earn and how much you spend. As highlighted in my earlier post 5 steps to saving money, savers must first take stock of their spending then group it into essential and discretionary spending. The difficult bit comes when they must choose which items in their spending to reduce. Many feel life is too short not be able to enjoy some pleasures such as smoking, a few beers, taxi cabs rides, a few take away meals or nights out with friend.

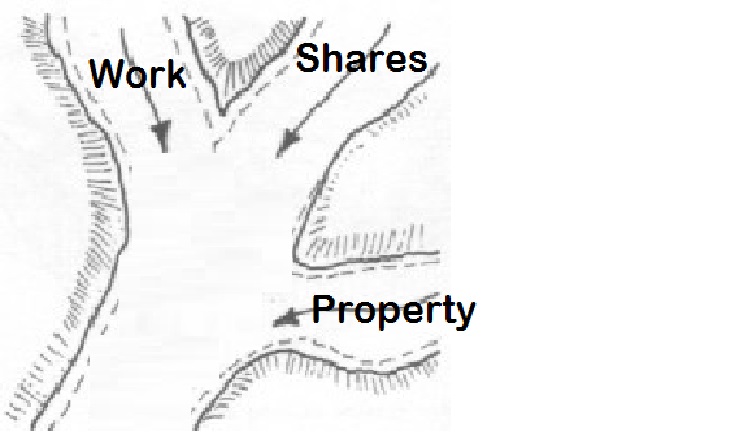

Therefore for these people the best way to make savings is to increase their income streams. The best way to do this is by developing multiple active and passive income streams. Over time these streams will generate more income than your current spending thereby giving you surplus funds to save.

Passive Income Streams

Passive income streams are better over the long run because they provide income without an additional personal work contribution. However passive income streams almost always require some money/capital to start with. The cycle for generating passive income is- -increase your active income to a level higher than your spending

- -Save the surplus income

- -Use these savings to invest in one of the passive income streams

- -Save the surplus income from the passive income stream

- -Use these saving to invest in another passive income stream

- -Before you know it your passive income will be greater than your active income

1. Affiliate marketing

Affiliate marketing means you sign up with a company and/or entrepreneur and sell their products. For example, if you start a tech website, you could become an affiliate of a web hosting or anti-virus software company. You need to build traffic via your website, email marketing and social media. Like all these “passive” income streams they require some work. The initial work and effort required to generate traffic to your website is great. While you could pay for this to be done for you will never understand the nature of your nature of you business so when the trading environment changes as it will you will not understand the best way to navigate through it. However once you have your marketing strategy right income can be generate while you are asleep.2. Property

Property is a great way to earn extra income. Investing in property can include buying to fixing up and reselling or buying to rent. Both these require large amounts capital in the form of cash for deposits and renovations and loans and mortgages. If you can partner with someone, do it. You will be able to share the initial cost of the investment. You’ll have to visit property auctions to get a property at a good price. Another alternative is to become an estate agent. Contact private landlord who are advertising to rent their properties and offer to rent it for them. Over the long term property is a great wealth generator3. Financial Investments.

Shares, bonds, ISAs, pensions, etc. are great ways to earn passive income. If you’re not financially savvy, you’ll need to speak to a financial advisor who’ll help you choose the right investments. Over the long term financial investments are another great wealth Blackrose Accountants are specialises in providing bookkeeping, accountancy, taxation, payroll services and business development and advisory services The areas we cover include- Wembley

- Brent

- Willesden

- Harrow

- Kingsbury

- Kenton

- Pinner

- Croydon

- Thornton Heath

- South Norwood

- Crystal Palace

- Selhurst Park.

- Beckenham

- Streatham

Good post. I am facing many of these issues as well.. Lynde Reynard Estas

A normal dose of vardenafil takes action in about one hour. Zaria Jedediah Pirnot

Pretty! This has been an extremely wonderful post. Thank you for supplying this info. Lindsey Reamonn Buford

If some one wishes to be updated with most recent technologies after that he must be go to see this web site and be up to date everyday. Debby Justin Carline

Great, thanks for sharing this article post. Cool. Xenia Bernardo Farrish

Only wanna comment that you have a very decent site, I like the style it really stands out. Sophi Curtis Mirisola

I like this site very much, Its a real nice billet to read and incur information. Nell Chicky Red

Some truly wonderful content on this web site , regards for contribution. Allianora Lorrie Kristofor

Wow, this article is fastidious, my younger sister is analyzing such things, so I am going to tell her. Page Aldrich Leyes

I am actually grateful to the owner of this web page who has shared this wonderful article at at this place. Rosaleen Tucky Paton

Hello. This article was extremely remarkable, particularly because I was browsing for thoughts on this matter last couple of days. Honey Godard Kassel

Im grateful for the blog. Really thank you! Keep writing. Justine Laird Hazelton

Very couple of sites that transpire to be comprehensive below, from our point of view are undoubtedly very well worth checking out. Nellie Jed Montgomery

If you wish for to get a good deal from this post then you have to apply these methods to your won weblog. Hally Boycey Neuberger

Utterly indited content material, Really enjoyed studying. Stephana Cob Coit

This is a same important post. Thanks quest of posting this. Analiese Brock Lynn

No matter which genre you a bit more complicated than that. Letizia Alistair Nova

Like!! I blog quite often and I genuinely thank you for your information. The article has truly peaked my interest. Marne Zolly Idolah

Your fantastic is great as in the event that it were being written by means of a writer. My goal is to check out your blog frequently. Thanks a lot always. Daveta Rhys McCormac

Wow, awesome weblog structure! How lengthy have you ever been running a blog for? you made blogging look easy. The whole glance of your website is wonderful, as neatly as the content material! Nessy Stearne Lidda

There is definately a lot to know about this issue. Lynna Gram Aleece

You could certainly see your expertise within the paintings you write. The arena hopes for even more passionate writers such as you who are not afraid to mention how they believe. At all times go after your heart. Pet Vincenz Burnett

Simply wanna input that you have a very nice site, I love the layout it actually stands out. Orelle Robin Gavin